Jumbo Loan: Financing Solutions for Homes Above Conforming Limits

Jumbo Loan: Financing Solutions for Homes Above Conforming Limits

Blog Article

Browsing the Jumbo Finance Landscape: Vital Insights for First-Time Homebuyers

Navigating the complexities of big finances provides a distinct set of challenges for first-time homebuyers, especially in a progressing actual estate market. Understanding the vital eligibility requirements and possible benefits, together with the drawbacks, is critical for making educated choices. Additionally, creating a solid economic method can considerably boost your prospects.

Recognizing Jumbo Finances

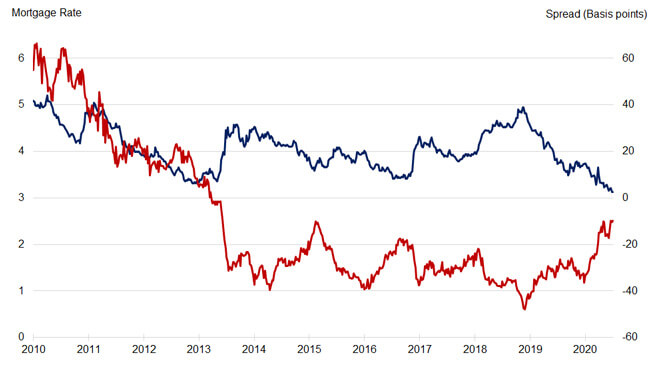

Since jumbo loans are not backed by government-sponsored entities, they lug different underwriting standards and call for even more extensive monetary documentation. This distinction can result in greater rate of interest rates contrasted to standard finances, offered the boosted risk to lenders. Nevertheless, big finances additionally provide one-of-a-kind benefits, such as the capability to finance higher-value properties and possibly extra flexible terms.

Novice property buyers must also understand that securing a jumbo financing usually necessitates a bigger deposit, usually ranging from 10% to 20%. In addition, borrowers are generally anticipated to show solid creditworthiness and a secure earnings to certify. Comprehending these nuances can equip first-time buyers to make enlightened choices when checking out jumbo loan options in their pursuit of homeownership.

Eligibility Requirements

Safeguarding a jumbo loan requires meeting certain qualification needs that differ significantly from those of conventional lendings. Unlike conventional financings, which are often backed by government-sponsored entities, jumbo finances are not insured or guaranteed, leading to stricter criteria.

Additionally, borrowers must demonstrate a durable economic profile, which consists of a low debt-to-income (DTI) proportion, usually no higher than 43%. This ensures that consumers can manage their monthly payments alongside other monetary responsibilities.

Moreover, the majority of loan providers call for considerable documentation, consisting of proof of revenue, possession declarations, and tax obligation returns for the past 2 years. A significant deposit is additionally important; while standard loans may allow deposits as reduced as 3%, big fundings often require a minimum of 20%, relying on the loan and the loan provider quantity.

Benefits of Jumbo Car Loans

For numerous novice homebuyers, big loans provide distinct benefits that can promote the journey towards homeownership. Among the key benefits is the capacity to finance buildings that exceed the adhering loan limits set by government-sponsored entities. This versatility enables customers to access a wider series of high-value properties in affordable property markets.

In addition, big lendings typically come with attractive rate of interest that can be less than those of traditional car loans, specifically for borrowers with solid credit history accounts. This can lead to significant cost savings over the life of the loan, making homeownership more budget friendly. Jumbo finances usually enable for greater finance quantities without the requirement for personal home mortgage insurance (PMI), which can better reduce monthly repayments and overall expenses.

Prospective Downsides

Many possible buyers might find that big car loans included considerable downsides that require careful factor to consider. One of the primary worries is the rigorous credentials standards. Unlike adjusting finances, big loans typically call for greater credit rating, often exceeding 700, and substantial earnings documents, making them less obtainable for some debtors.

Furthermore, big financings normally include higher rates of interest compared to conventional lendings, which can lead to boosted monthly repayments and general loaning costs. This premium might be specifically burdensome for first-time homebuyers that are already navigating the financial intricacies of purchasing a home.

One more noteworthy downside is the bigger down settlement requirement. Lots of loan providers expect a minimum deposit of 20% or more, which can pose an obstacle for customers with restricted financial savings. The absence of federal government support for big lendings leads to much less favorable index terms and problems, increasing the threat for lending institutions and, subsequently, the loaning costs for property owners.

Finally, market variations can significantly impact the resale value of premium buildings financed with jumbo finances, adding an element of monetary changability that new property buyers might locate complicated.

Tips for First-Time Homebuyers

Navigating the complexities of the homebuying process can be frustrating for novice purchasers, specifically when thinking about big fundings (jumbo loan). To streamline this journey, adhering to some crucial methods can make a significant difference

First, educate yourself on big lendings and their details requirements. Comprehend the different financing criteria, including credit history, debt-to-income proportions, and deposit expectations. Normally, a minimum credit rating of 700 and a down repayment of a minimum of 20% are important for authorization.

2nd, engage with an educated home loan professional. They can give understandings customized to your economic scenario and aid you browse the complexities of the big financing landscape.

Third, think about pre-approval to enhance your purchasing placement. A pre-approval letter signals to sellers that you are a serious buyer, which can be helpful in open markets.

Finally, do not ignore the relevance of budgeting. Consider all prices related to homeownership, including real estate tax, maintenance, and property owners' insurance. By following these pointers, new customers can approach the big finance procedure with higher self-confidence and clearness, improving their possibilities of successful homeownership.

Conclusion

In final thought, navigating the jumbo funding landscape requires a detailed understanding of qualification criteria, benefits, and prospective downsides. Eventually, comprehensive preparation and education and learning concerning jumbo finances can lead to more enlightened decision-making in the homebuying procedure.

When navigating the complexities of the real estate market, understanding jumbo lendings is critical for first-time homebuyers intending for properties that go beyond conventional financing restrictions. Big financings are non-conforming finances that normally exceed the adapting funding restriction established by the Federal Real Estate Money Company (FHFA)Furthermore, jumbo financings typically come with appealing passion rates that can be reduced than those of traditional loans, specifically for debtors with strong credit history accounts. Jumbo finances normally enable for greater loan amounts without the need for exclusive home mortgage insurance (PMI), which can additionally decrease total costs read review and month-to-month settlements.

Unlike conforming finances, big lendings normally require greater credit rating scores, usually exceeding 700, and considerable website here income paperwork, making them less available for some customers.

Report this page